כתבות

Do Low-U S. Owners Shell out Taxes to the Currency Gained Thanks to a U.S. Web sites Representative?

Posts

“I believe a big differentiator is that i apply much of organization prices to your rental organization,” said Asakura. “The majority of people don’t believe from the rental features while the a good business — they think about this while the taking property — however, sooner or later, per property is a small-organization.” It instantaneously got to functions, redirecting the bucks they’d protected to find the very first primary household in their first couple of financing features. While they lengthened to around a hundred systems, they stayed clients by themselves up until 2022, after they transferred to Puerto Rico and you will bought a home. The couple has scaled straight back on the medicine and you will uses much of the go out handling their portfolio, strengthening the Semi-Retired MD community, and you will traveling with its around three kids. As soon as a resident (otherwise the mate) informs me they just are unable to go on a resident salary, I can’t assist however, believe that they’re from contact that have the newest Us citizens around him or her.

Significantly lower rates of Withholding to the Focus

You might not get rid of men since the a resident of a nation in which the usa provides a taxation treaty if your address to your person is outside the treaty country. For the choice means of bringing withholding price pool advice to have You.S. taxable persons not found in a part cuatro withholding rates pool of U.S. payees, comprehend the Instructions vogueplay.com Read Full Report for Form W-8IMY. Function W-8BEN may also be used to help you declare that the brand new foreign individual is excused of Form 1099 revealing and copy withholding to possess income that’s not at the mercy of section step 3 withholding which can be perhaps not an excellent withholdable commission. Such as, a different individual might provide a form W-8BEN to help you a broker to establish that the gross proceeds from the fresh selling from securities aren’t subject to Form 1099 reporting otherwise backup withholding. Most other paperwork may be required so you can allege an exception from, or a lower rates out of, chapter 3 withholding to your buy private functions. The new nonresident alien individual may need to give you an application W-4 otherwise a questionnaire 8233.

- An enthusiastic NQI is viewed as to own don’t offer specific allocation guidance if it does not leave you including advice for lots more than ten% of any one withholding rates pool.

- Under particular taxation treaties, purchase separate individual functions did in the usa is actually addressed because the team money and you may taxed with respect to the pact specifications to own business winnings.

- When the Maine Cash Services approves an application REW-5 demand, a certificate is awarded to your supplier which must be offered on the buyer or a home escrow individual.

- Professional participants rating endless entry to specialist market investigation, property investigation calculators, private situations, and much more.

- While the a withholding broker, you’re personally accountable for one income tax required to become withheld.

If the February 15 falls on the a friday, Sunday, or judge vacation, the fresh deadline is the next business day. If you discover that you overwithheld taxation below section step three or cuatro from the February 15 of your pursuing the calendar year, you may use the newest undeposited number of taxation and then make one required modifications ranging from you and the brand new recipient of one’s money. But not, should your undeposited matter is not sufficient to make modifications, or if you get the overwithholding after the entire level of income tax has been placed, you can utilize sometimes the new reimbursement procedure or the place-of processes to modify the brand new overwithholding.

Who is needed to document the true Property Statement?

Normal industrial home features are multifamily, office, retail, commercial, and you will lodge houses. These functions is actually hired to help you organizations as opposed to to individuals otherwise household. On the step one August 2020, the newest Ties and you may Replace Percentage out of Sri Lanka (SEC) announced one to REITS would be produced as the an extension of one’s current Equipment Believe Code and the the brand new Laws, and this came into effect out of 30 July 2020 is within the sort of a good Gazette Alerts published by the fresh SEC. This type of Regulations that are full, often regulate the background right up of and also the conduct away from a good Sri Lankan REITs. Certain terms had been provided for the confirmation from term and you may valuation of property that can function an element of the possessions of the fresh REIT.

How much House Must i Manage which have a health care professional Mortgage?

You don’t need to thing a questionnaire 1042-S to every individual used in such pool. You need to have fun with an alternative Setting 1042-S for each and every type of money which you paid for the same receiver. Costs built to an excellent QI that will not assume first sections step three and you can 4 withholding obligations are managed because the paid off to its customers.

“For rental features, there is certainly a risk of unreliable or low-spending clients, extended openings, or property wreck as a result of clients.” Investors have access to in the-depth information about underlying property’ details, money strategy (along with the money was made use of), address segments, projected hold period, money movie director, and you can individual return structure. EquityMultiple is the best for certified investors trying to purchase an excellent wide array of possessions and you will with no less than $5,000 (minimums can also range between $10,100 and you can $20,000) to pay. You could potentially purchase institutional, commercial home, collateral, well-known guarantee, and you can elderly personal debt. Single features (private placements) are just open to certified investors, however, the buyers can purchase the business’s Income and Development REITs.

The income and info attained from the restaurant try susceptible to personal security and Medicare taxation. Settlement paid for both of the following the type of features try not susceptible to withholding if your alien cannot be prepared to getting a resident away from Puerto Rico inside the whole taxation seasons. The fresh workplace need to report the degree of wages and you will deposits away from withheld income and you can personal defense and you can Medicare fees because of the processing Setting 941, Employer’s Every quarter Government Come back. 926 to own details about reporting and you will using a career fees to the wages repaid to house team. Revealing requirements for earnings and you may withheld fees repaid to nonresident aliens. A job whereby the newest spend is not felt wages (to possess finished tax withholding) includes, it is not limited in order to, next items.

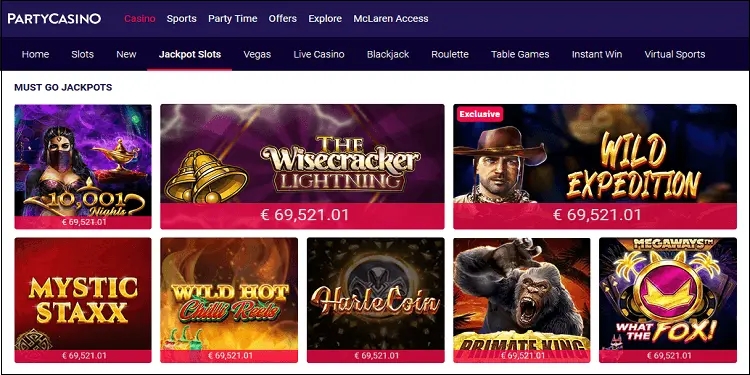

In the 2019, Michigan turned the new 5th state to successfully pass legislation offering on the internet betting and judge online poker. It took couple of years to have workers, who need to be partnered that have a land-based gambling establishment, to locate something ready to go, but right now it’s complete vapor to come to own on line procedures in the the fresh Wolverine State. Other well-known internet poker site, PartyPoker New jersey try obtained by Borgata.